Estate Planning

The Rule of Thumb for Retirement Savings: Generating $90,000 Annually for 30 Years

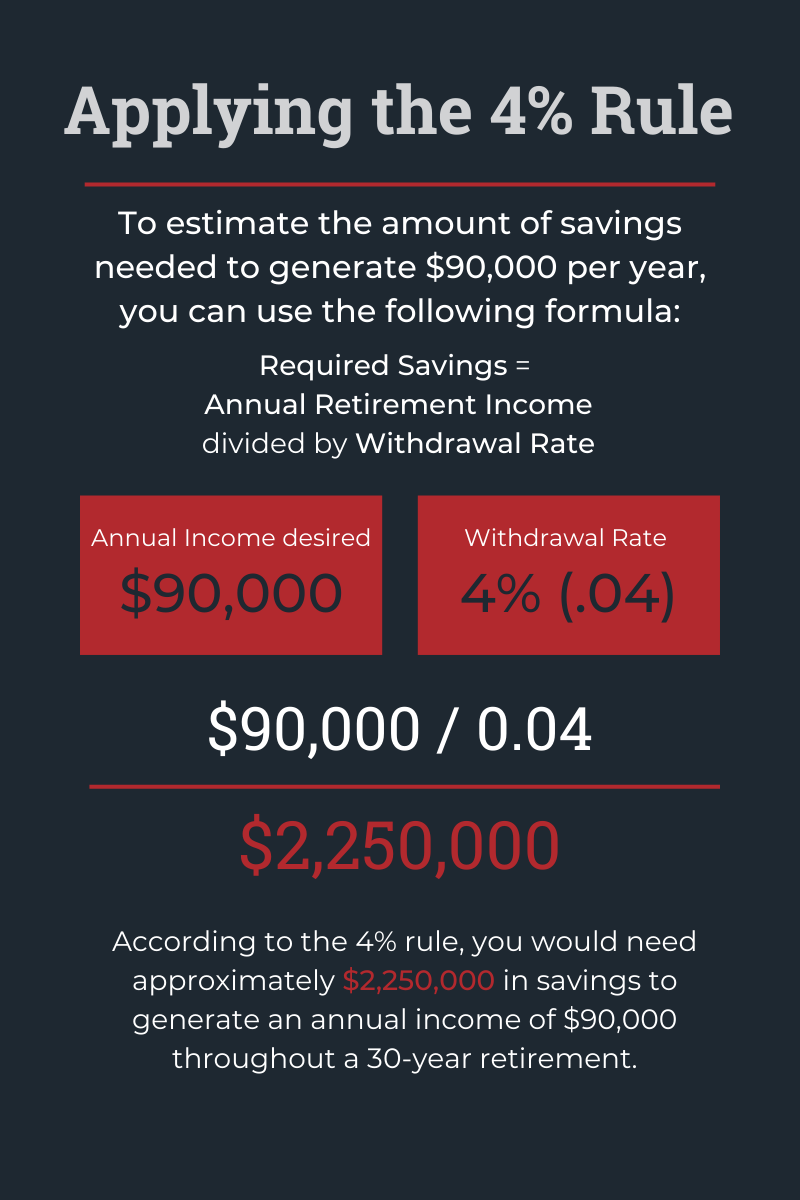

Planning for retirement requires careful consideration of your financial goals and the lifestyle you envision during your golden years. One common objective is to ensure a steady income stream throughout retirement. In this article, we'll explore a rule of thumb to estimate the amount of savings you might need to generate $90,000 annually for 30 years.

4 Tips for Smart Retirement Planning

4% Rule Factors to Consider

- Inflation: The 4% rule takes inflation into account, allowing for adjustments in annual withdrawals. Keep in mind that over a 30-year period, the cost of living is likely to increase, affecting your purchasing power.

- Investment Returns: The rule assumes a balanced investment portfolio that generates an average annual return of at least 4%. The actual returns on your investments will impact the sustainability of your withdrawals.

- Healthcare Costs: Consider potential healthcare expenses during retirement, as they can be a significant factor. Having a comprehensive healthcare plan is crucial for maintaining financial stability.

- Lifestyle and Spending Habits: Your individual lifestyle choices and spending habits will influence your retirement income needs. Be realistic about your anticipated expenses and adjust your savings plan accordingly.

The 4% Rule

The 4% rule is a widely recognized guideline for retirement planning. This rule suggests that you can withdraw 4% of your retirement savings annually, adjusting for inflation, without significantly depleting your nest egg. The idea is to strike a balance between enjoying your retirement years and preserving your savings for the long term.

While the 4% rule provides a useful starting point for estimating retirement savings, it's essential to personalize your plan based on your unique circumstances. Regularly review and adjust your strategy as needed with your financial advisor, taking into account changes in your financial situation, market conditions, and life circumstances. Seeking guidance from a financial advisor like Michael D. Peroo, CPA can also help ensure that your retirement plan aligns with your specific goals and aspirations.

Categories

- All

- Auditing(2)

- Business Planning(7)

- CFO Services/Accounting(3)

- City & County Budgeting(1)

- Estate Planning(4)

- Fiscal Sustainability(3)

- Healthcare(1)

- IRS Representation(2)

- Mergers & Acquisition(1)

- Retirement Planning(8)

- Tax Planning & Consulting(7)

- Utility Rate Study(1)