NEWS & EVENTS

WHAT’S THE LATEST

Cash Flow Planning in Retirement

Retirement marks a significant life transition, and as individuals bid farewell to the daily grind, careful consideration must be given to financial planning. Among the key aspects of retirement planning, cash flow planning stands out as a critical component. In this article, we explore why cash flow planning for retirement is of paramount importance and […]

READ MORETax Planning & Consulting

Income Tax Requirements for Day Traders

Day trading, the act of buying and selling financial instruments within the same trading day, has gained popularity as a means to generate income. However, day traders must be aware of specific income tax requirements that come with this type of trading activity. Let's explore the key considerations and requirements for day traders when it comes to income tax.

Understanding Income Tax Requirements for Day Traders

Tax Classification

Day traders are generally classified as individuals engaged in the business of buying and selling securities. This classification is important for determining the tax treatment of gains and losses.

Trader Status

To benefit from certain tax advantages, day traders may seek "Trader Status." This status allows them to deduct business-related expenses and qualify for the mark-to-market accounting method. However, meeting the criteria for trader status can be challenging, and it's essential to consult with a tax professional.

Mark-to-Market Accounting

Traders with a trader status can use the mark-to-market accounting method. This involves reporting gains and losses on a yearly basis, as if the securities were sold at their market value on the last business day of the tax year. This can simplify tax reporting and may result in more favorable tax treatment.

Capital Gains and Losses

Day traders often generate both short-term and long-term capital gains and losses. Short-term gains are typically taxed at the individual's ordinary income tax rates. It's crucial to keep detailed records of all trades to accurately calculate gains and losses.

Business Expenses

Day traders may deduct certain business-related expenses, such as trading platform fees, data subscriptions, and home office expenses. These deductions can help reduce taxable income.

Wash Sale Rules

Day traders need to be aware of the wash sale rules, which prevent the immediate repurchase of a substantially identical security within 30 days of selling it at a loss. Violating these rules can result in the disallowance of the loss for tax purposes.

Self-Employment Taxes

Traders with a trader status are generally considered self-employed. As such, they may be subject to self-employment taxes, including Social Security and Medicare taxes. Proper tax planning is crucial to manage these additional tax liabilities.

Recordkeeping

Accurate recordkeeping is essential for day traders. Detailed records of each trade, including dates, amounts, and associated expenses, should be maintained. This documentation is critical for tax reporting and potential audits.

MDP Can Help with Day Trader Income Tax Requirements

Day trading for income can be a lucrative venture, but it comes with specific income tax requirements that traders must navigate. Seeking professional advice and staying informed about tax regulations can help day traders optimize their tax positions, minimize liabilities, and ensure compliance with applicable tax laws. As the tax landscape is complex and subject to change, it's advisable for day traders to consult with qualified tax professionals to address their individual circumstances.

Business Planning

How Do Restricted Stock Units (RSU) Work?

Navigating the world of stock options and equity compensation can be a complex and confusing process, especially when it comes to restricted stock units (RSUs). Fortunately, a certified public accountant like Michael D. Peroo, CPA, can provide expert guidance to both companies and employees looking to maximize the benefits of RSUs.

Understanding How RSU's Work

Granting RSUs:

- Companies grant RSUs to employees as part of their overall compensation package.

- RSUs are typically offered to attract and retain talented employees, aligning their interests with the company's success.

Vesting Period:

- RSUs come with a vesting period, during which employees cannot sell or transfer the shares.

- Vesting periods vary, but they commonly span over a few years. It's a way to encourage employees to stay with the company.

Cliff Vesting vs. Gradual Vesting:

- Some RSUs have a cliff vesting structure, meaning that a certain percentage vests all at once after a specified period (e.g., one year).

- Others have a gradual vesting schedule, where a percentage of RSUs vests over regular intervals.

Vesting Triggers:

- Vesting is triggered by different events, such as the passage of time (time-based vesting) or the achievement of performance milestones (performance-based vesting).

- Common time-based vesting might be, for example, 25% of RSUs vesting each year over four years.

Tax Implications:

- RSUs have tax implications. When RSUs vest, the value is considered taxable income, and taxes need to be paid.

- The tax treatment may vary depending on the country and local tax laws.

Settlement:

- Once RSUs vest, they are settled, meaning employees receive the shares or their cash equivalent, depending on the company's policy.

- Some companies allow employees to choose between receiving shares or selling them and taking the cash.

Stock Price Fluctuations:

- The value of RSUs is tied to the company's stock price. Therefore, employees benefit from any increase in the stock price but are also exposed to potential losses.

Leaving the Company:

- If an employee leaves the company before RSUs fully vest, they may forfeit the unvested portion. However, some companies have provisions for partial vesting in case of certain circumstances like retirement or acquisition of the company.

Employee Ownership:

- RSUs promote a sense of ownership among employees, as they have a stake in the company's performance and stock value.

Communication and Education:

- Companies often communicate the details of RSUs clearly to employees to ensure they understand the terms, vesting schedule, and tax implications.

In summary, RSUs serve as a valuable tool for companies to attract, retain, and motivate employees by tying their compensation to the company's performance and stock value. Employees, in turn, have the opportunity to benefit from the company's success and align their interests with the long-term goals of the organization.

As an experienced financial professional, Michael D. Peroo, CPA, understands the nuances of RSUs and can offer strategic advice to help employees make informed decisions about their stock options, while also helping companies structure their equity compensation plans to attract and retain top talent. With MDP's guidance, both employees and employers can take full advantage of the potential benefits that come with restricted stock units and company stock. Contact us today!

Business Planning

Leveraging an S-Election to Optimize Employment Tax Savings

Small business owners often seek effective strategies to minimize their tax liabilities while maximizing profits. One powerful tool at their disposal is the S-corporation election (S-election). Choosing S-corporation status can provide substantial advantages, particularly in terms of employment tax savings. In this article, we will explore the benefits of making an S-election and how it can contribute to significant tax savings for businesses.

Understanding the S-Corporation Election and How It Can Help

An S-corporation is a pass-through entity that allows business income, deductions, and credits to flow through to shareholders for tax purposes. Unlike a traditional C-corporation, an S-corporation is not subject to federal income tax at the entity level. Instead, income and losses are reported on the shareholders' individual tax returns.

Reducing Self-Employment Taxes

One of the primary advantages of choosing S-corporation status is the potential for substantial savings on self-employment taxes. In a sole proprietorship or partnership, business owners are subject to self-employment taxes on their entire net income. By contrast, S-corporation shareholders can structure their compensation to include a combination of wages and dividends, potentially reducing their overall employment tax liability.

Splitting Income Between Wages and Distributions

S-corporation shareholders who actively participate in the business have the flexibility to receive income in the form of both reasonable wages and distributions. While wages are subject to employment taxes (Social Security and Medicare taxes), distributions are not. By strategically balancing the mix of wages and distributions, business owners can minimize the portion of income subject to these taxes.

Reasonable Compensation Requirements

It's important to note that the Internal Revenue Service (IRS) requires S-corporation shareholders to receive "reasonable compensation" for the services they provide to the business. While distributions are not subject to employment taxes, the IRS expects shareholders to receive a reasonable salary for their work. Determining what constitutes reasonable compensation is a critical aspect of optimizing tax savings while remaining compliant with tax regulations.

Ensuring Compliance and Documentation

To benefit from employment tax savings without running afoul of IRS regulations, it's crucial for S-corporation shareholders to maintain accurate records of compensation decisions. Keeping detailed documentation that justifies the chosen salary as reasonable for the services rendered is essential to demonstrate compliance during potential IRS scrutiny.

Consulting with Tax Professionals

Given the complexity of tax laws and the importance of compliance, business owners considering an S-election should seek guidance from qualified tax professionals. Tax advisors can help structure compensation plans, navigate tax regulations, and ensure that the chosen strategy aligns with the specific circumstances of the business.

Seek Help from a CPA for Your Tax Planning

Utilizing an S-election to save on employment taxes is a strategic move that can yield substantial benefits for small business owners. By carefully managing the mix of wages and distributions, adhering to reasonable compensation standards, and seeking professional guidance, entrepreneurs can optimize their tax positions and enhance the financial health of their businesses. Before making any decisions, it's advisable to consult with tax professionals like Michael D. Peroo, CPA who can provide tailored advice based on the unique characteristics of each business.

Demystifying Medicare Part B Premiums: How the Costs are Calculated

Medicare, the federal health insurance program in the United States, is a vital resource for millions of Americans, providing coverage for hospital stays, medical services, and more. Medicare is divided into different parts, each addressing specific aspects of healthcare. In this article, we will delve into Medicare Part B and explore how its premiums are calculated.

Understanding Medicare Part B

Medicare Part B primarily covers outpatient services, preventive care, and doctor visits. It plays a crucial role in ensuring comprehensive healthcare coverage for individuals aged 65 and older, as well as certain younger individuals with qualifying disabilities.

Calculating Medicare Part B Premiums

The standard premium for Medicare Part B is calculated annually and can be influenced by various factors. As of my last knowledge update in January 2022, here is a breakdown of how Medicare Part B premiums are determined:

1. Base Premium:

The standard premium is a base amount that is set by the federal government. In recent years, this amount has been subject to change and is influenced by various economic factors.

2. Income-Related Monthly Adjustment Amount (IRMAA):

For individuals with higher incomes, an Income-Related Monthly Adjustment Amount (IRMAA) may apply. IRMAA is an additional amount added to the standard premium based on the individual's modified adjusted gross income (MAGI) from two years prior. The MAGI is calculated by adding back certain deductions to the adjusted gross income reported on the tax return.

3. Medicare Hold Harmless Provision:

The Medicare Hold Harmless provision ensures that the increase in Medicare Part B premiums for existing enrollees does not exceed the increase in their Social Security benefits. This provision protects individuals from a significant reduction in their net Social Security income due to an increase in Medicare premiums.

4. New Enrollees and Those Not Subject to Hold Harmless:

Individuals who are new to Medicare or those not subject to the Hold Harmless provision may experience different premium amounts. New enrollees typically pay the standard premium unless they qualify for assistance programs.

5. State Assistance Programs:

Some individuals may qualify for state assistance programs that help cover the costs of Medicare premiums, including those for Part B. These programs vary by state, and eligibility is often based on income and other factors.

Plan Healthcare Expenses Effectively

Understanding how Medicare Part B premiums are calculated is crucial for beneficiaries to plan for their healthcare expenses effectively. The interplay of base premiums, income-related adjustments, and other provisions can result in different premium amounts for individuals. As healthcare policies and regulations may change, it's advisable to check the latest information from official Medicare sources or consult with a qualified healthcare professional to get the most accurate and up-to-date details.

Unlocking the Benefits: The Pros of Setting Up a Living Trust

Estate planning is a vital component of ensuring your assets are managed and distributed according to your wishes, both during your lifetime and after your passing. One powerful tool in the realm of estate planning is the living trust. Let's explore the various advantages and pros of setting up a living trust to help you make informed decisions about your estate.

What Are the Benefits of Setting Up a Living Trust

Probate Avoidance

One of the primary advantages of a living trust is its ability to bypass the probate process. Probate is a legal procedure during which a court validates a will, ensures debts are paid, and assets are distributed. By placing your assets in a living trust, they are not subject to probate, allowing for a more seamless and private transfer of assets to beneficiaries.

Privacy

Living trusts offer a higher level of privacy compared to wills. Probate proceedings are matters of public record, meaning that details of your estate, assets, and beneficiaries become accessible to the public. A living trust, being a private document, allows for a more discreet distribution of assets without public scrutiny.

Incapacity Planning

Living trusts provide for the management of your assets in the event of your incapacity. If you become unable to manage your affairs, the successor trustee named in the trust can step in and handle the administration of the trust without the need for court involvement. This ensures a smoother transition of control and minimizes the potential for conflicts.

Faster Asset Distribution

Assets held in a living trust can be distributed to beneficiaries more quickly than those subject to probate. Since the trust operates independently of the court system, the successor trustee can distribute assets promptly, avoiding the often time-consuming probate process.

Flexibility in Distribution

A living trust allows for flexibility in the distribution of assets. For example, you can set specific conditions or staggered distributions for beneficiaries based on certain milestones, such as age, education, or life events. This flexibility provides a level of control over how and when your assets are distributed.

Potential Tax Planning

While the tax implications of a living trust can vary, it may offer potential benefits for tax planning. Certain trusts, such as irrevocable trusts, can be structured to minimize estate taxes and provide tax advantages for beneficiaries.

Ease of Management

Living trusts are revocable during your lifetime, providing the flexibility to make changes as needed. You can add or remove assets, amend beneficiaries, or even revoke the trust entirely if circumstances change. This adaptability makes living trusts a dynamic and user-friendly estate planning tool.

Let Michael D. Peroo, CPA Help You Set Up Your Living Trust

Setting up a living trust can offer numerous advantages in streamlining the distribution of assets, enhancing privacy, and providing for efficient management during incapacity. As with any legal and financial decision, it's crucial to consult with qualified legal and financial professionals like Michael D. Peroo to tailor a living trust to your specific needs and ensure compliance with applicable laws. By taking these proactive steps, you can gain peace of mind knowing that your estate is well-organized and aligned with your wishes.

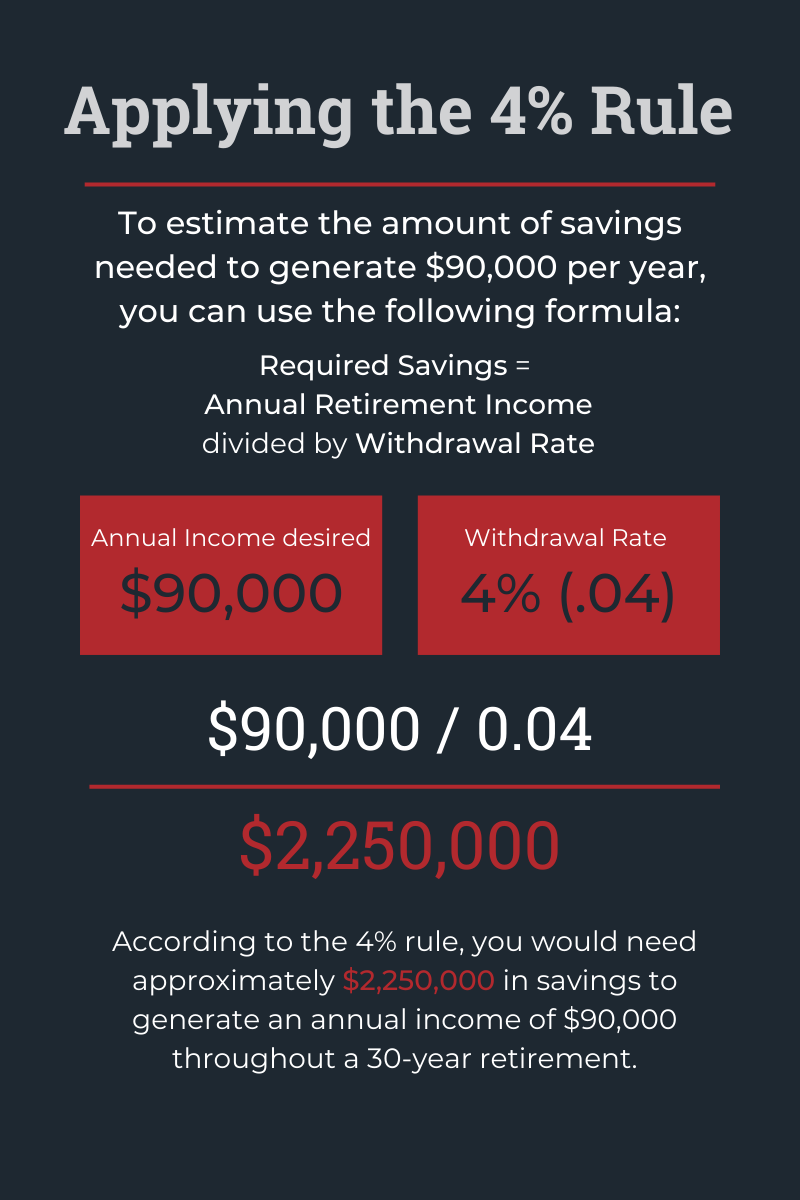

The Rule of Thumb for Retirement Savings: Generating $90,000 Annually for 30 Years

Planning for retirement requires careful consideration of your financial goals and the lifestyle you envision during your golden years. One common objective is to ensure a steady income stream throughout retirement. In this article, we'll explore a rule of thumb to estimate the amount of savings you might need to generate $90,000 annually for 30 years.

4 Tips for Smart Retirement Planning

4% Rule Factors to Consider

- Inflation: The 4% rule takes inflation into account, allowing for adjustments in annual withdrawals. Keep in mind that over a 30-year period, the cost of living is likely to increase, affecting your purchasing power.

- Investment Returns: The rule assumes a balanced investment portfolio that generates an average annual return of at least 4%. The actual returns on your investments will impact the sustainability of your withdrawals.

- Healthcare Costs: Consider potential healthcare expenses during retirement, as they can be a significant factor. Having a comprehensive healthcare plan is crucial for maintaining financial stability.

- Lifestyle and Spending Habits: Your individual lifestyle choices and spending habits will influence your retirement income needs. Be realistic about your anticipated expenses and adjust your savings plan accordingly.

The 4% Rule

The 4% rule is a widely recognized guideline for retirement planning. This rule suggests that you can withdraw 4% of your retirement savings annually, adjusting for inflation, without significantly depleting your nest egg. The idea is to strike a balance between enjoying your retirement years and preserving your savings for the long term.

While the 4% rule provides a useful starting point for estimating retirement savings, it's essential to personalize your plan based on your unique circumstances. Regularly review and adjust your strategy as needed with your financial advisor, taking into account changes in your financial situation, market conditions, and life circumstances. Seeking guidance from a financial advisor like Michael D. Peroo, CPA can also help ensure that your retirement plan aligns with your specific goals and aspirations.

Categories

- All

- Auditing(2)

- Business Planning(7)

- CFO Services/Accounting(3)

- City & County Budgeting(1)

- Estate Planning(4)

- Fiscal Sustainability(2)

- Healthcare(1)

- IRS Representation(2)

- Mergers & Acquisition(1)

- Retirement Planning(8)

- Tax Planning & Consulting(7)

- Utility Rate Study(1)